Fed rate hike

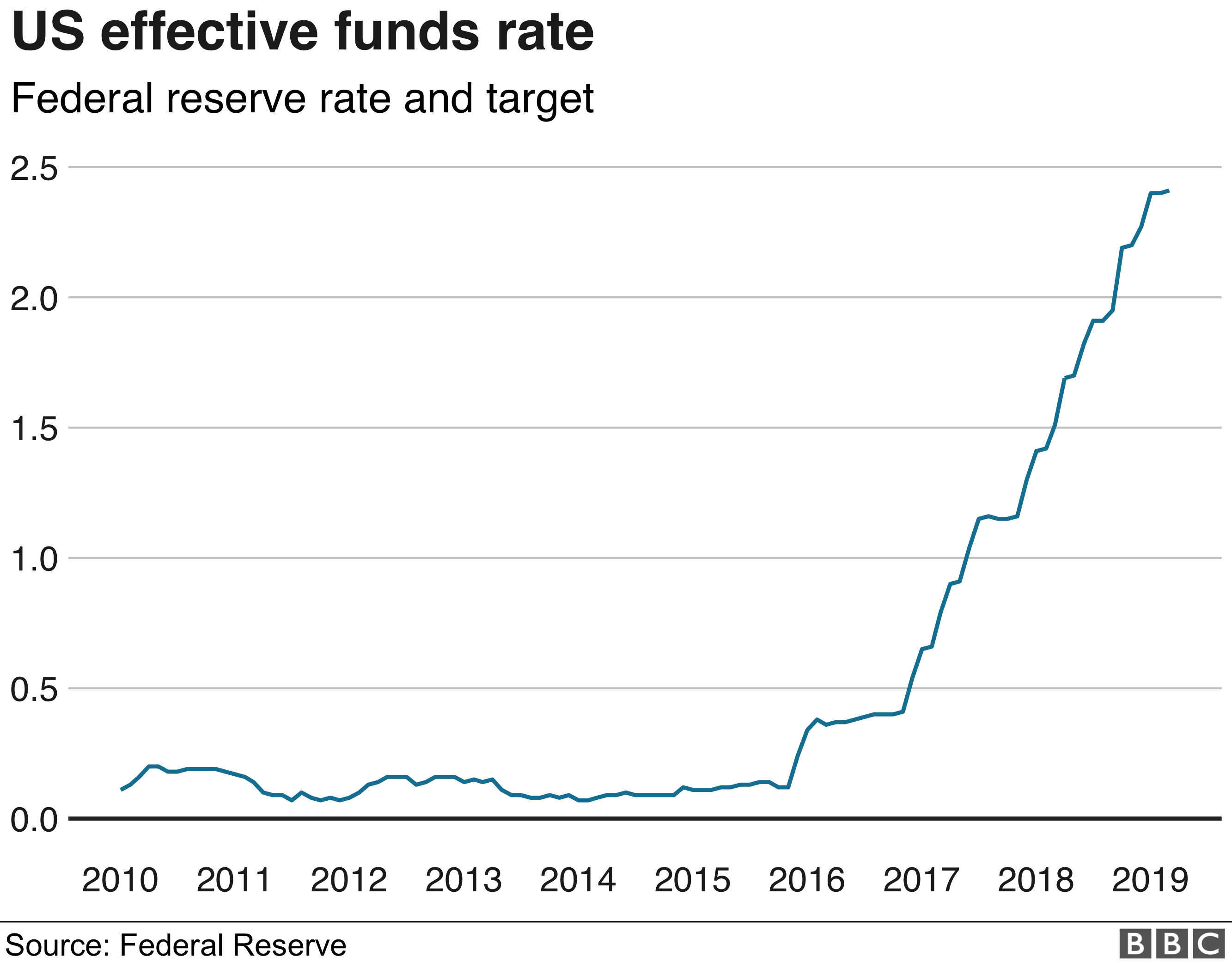

The Fed has increased its benchmark lending rate six times this year in an attempt to discourage borrowing cool the economy and bring down historically high inflation. According to Federal Reserve.

Interest Rates Vs Inflation Country By Country Approach World Economic Forum

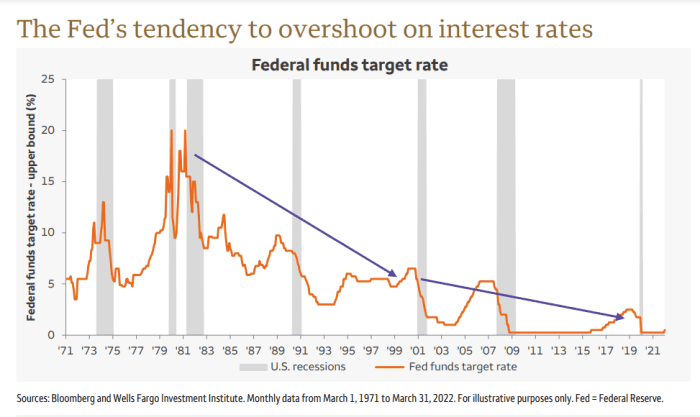

Historically when interest rates rise the high cost of borrowing helps to stall the economy with fewer consumers.

. The Federal Reserve has announced that it will raise interest rates another 05 percent to 45 percent marking the seventh increase of 2022. This is only the first rate hike that the US. The increase in the short-term benchmark fed funds rate on Wednesday brings the target range to between 425 and 45 the highest level since 2007 and from 0 to 025.

13-14 after four successive 75 basis-point hikes. The Federal Reserve made history on Wednesday approving a third consecutive 75-basis-point hike in an aggressive move to tackle the white-hot inflation that has been. The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008.

The Feds rate hikes have had a clear impact on the housing market with surging mortgage rates helping to put a dent into home sales. During his post-meeting conference Fed Chair Jerome Powell. 1 day agoThe US.

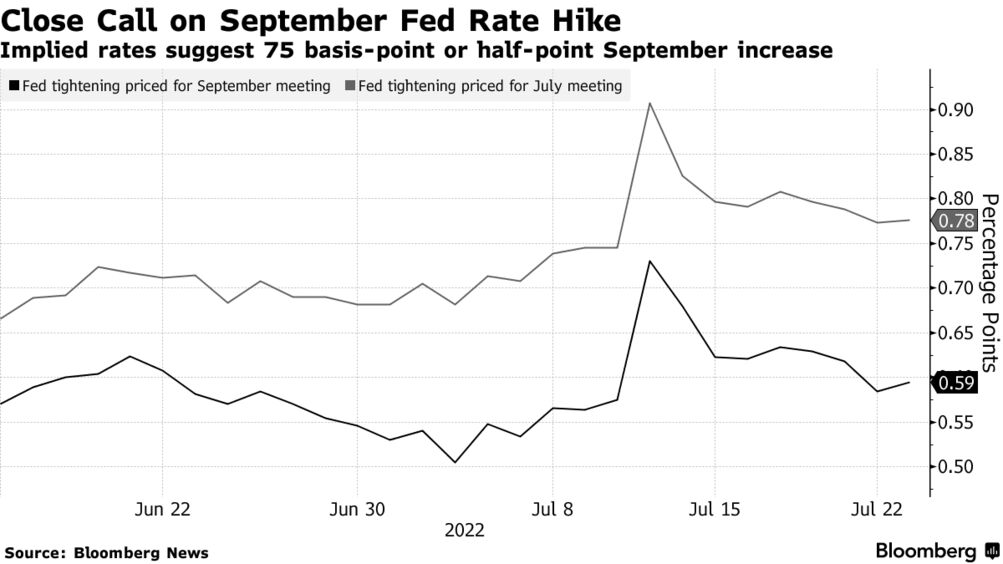

But thats still at historical lows. Yesterday the Fed raised this rate by one-quarter of a percentage point. Fed officials have signaled they plan to raise their benchmark rate by 50 basis points at their final meeting of the year on Dec.

Bedeviled by high inflation Federal Reserve hikes interest rate by 075 again. Two Scenarios for Fed Policy in 2023. 7 hours agoNEW YORK AP The Federal Reserves move Wednesday to raise its key rate by a half-point brought it to a range of 425 to 45 the highest level in 14 years.

Savings account yields could increase as well. The Fed has hiked by three-quarters of percentage point at its last four meetings. The Fed hopes to stop hiking rates early next year but that depends on inflation and the economy.

1 day agoThe Federal Reserve has raised interest rates for the seventh time this year while signaling that it is moving more cautiously as the US. This will however be the. The tight monetary policy from the Fed has already included three outsized 75 basis point rate hikes a 50 basis point rate hike and a 25 basis point rate hike all in a bid to tame inflation.

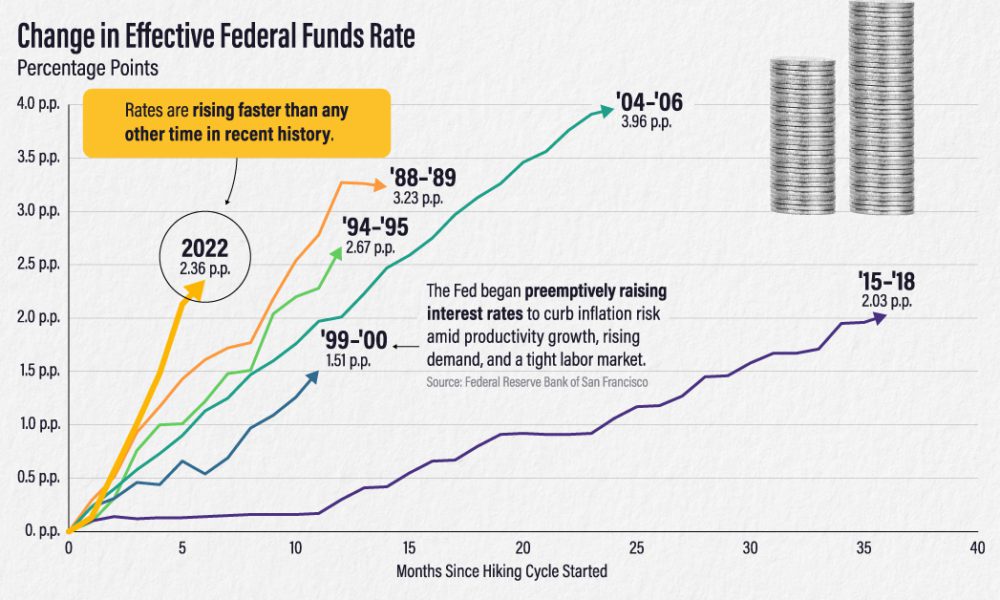

So far the Feds five hikes in 2022 have increased rates by a combined 3 percentage points which means consumers are now paying an extra 300 in interest on. While the Fed chief did not indicate his estimated terminal rate Powell said it is likely to be somewhat higher than the 46 indicated by policymakers in their September. The Federal Open Market Committee said it was increasing its key federal funds rate by 05 after announcing four-straight 075 hikes at its most recent meetings.

The Fed has also initiated a reduction of its near 9 trillion balance sheet as it rolls off 95 billion per month in a combination of Treasury and. However the market still sees a 25 probability of another larger three-quarter-point hike. The central bank hopes to curb spending investment and borrowing in order to cool off further.

Central bank is widely expected to lift the federal funds rate by 50 basis points at the conclusion of its two-day meeting on Wednesday a slightly smaller increase. Rate hikes are the Feds main countermeasure against inflation. The Fed does expect the unemployment rate to rise somewhat inching up to 44 next year.

Fed Raises Interest Rates Keeps Forecast For 3 Hikes In 2018

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

S Ds On Expected Interest Rates Hike We Must Avoid Mistakes Of The Past And Protect The Most Vulnerable Europeans Socialists Democrats

:max_bytes(150000):strip_icc()/fredgraph-a800d4ef93634168b10b23290a1a57d1.png)

Federal Reserve Interest Rate Hikes In Investors Crosshairs

Bank Indonesia Goes For 0 50 Interest Rate Hike At September 2022 Policy Meeting Indonesia Investments

Federal Reserve Interest Rate Hike Will The Fed Decrease Its Pace The Next Time

Fed Readies Largest Interest Rate Hikes Since Volcker Decision Day Guide Bloomberg

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch

A History Of Fed Leaders And Interest Rates The New York Times

Take Five It S Rate Hike Central

Chart The Fed Is Moving Historically Fast To Tame Inflation Statista

10 Year Yields Highest Since 2011 Before Expected Fed Rate Hike

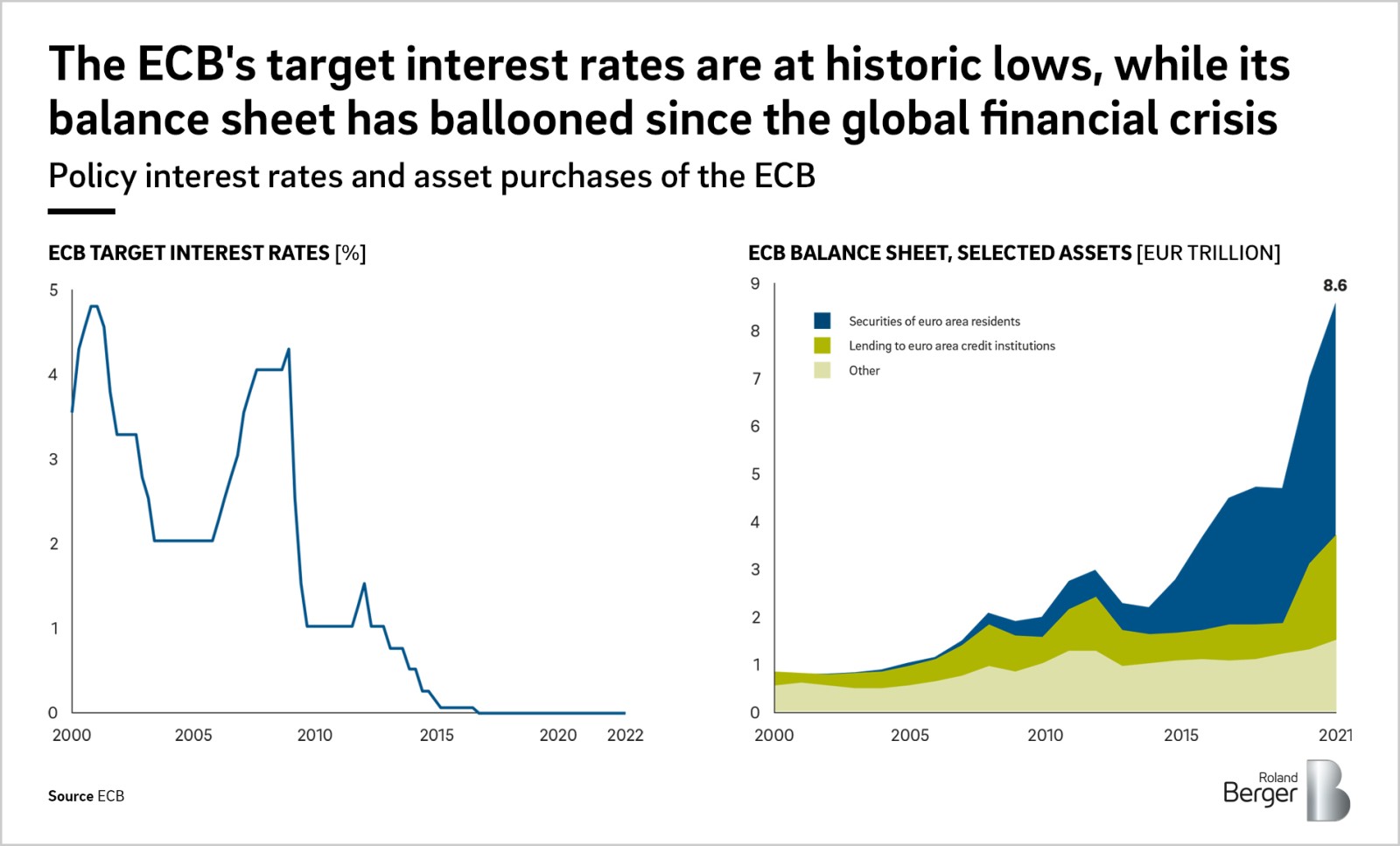

What If The Ecb Raises The Key Interest Rates Roland Berger

Doshi Associates Cpa Pllc Interest Rate Hike

3 Things To Do Now After The Fed S Biggest Interest Rate Hike In Almost 30 Years

Us Fed Defies Trump And Holds Interest Rates Bbc News

Usa Today On Twitter The Federal Reserve Bumped Interest Rates Up For The Sixth Time This Year To Ward Off Rising Inflation Here S What That Will Mean For Your Finances Https T Co J8ryxsg37o Https T Co Qved9cymy7